![]()

Supplements

A supplement is a replacement record for a parcel that has already been abstracted for the current year. Supplements are created to correct errors or update new parcel information. Common assessment supplements will focus on name, class, exemption, and agricultural use changes. This Quick Help shows users how to create supplements and the related letters in Capture.

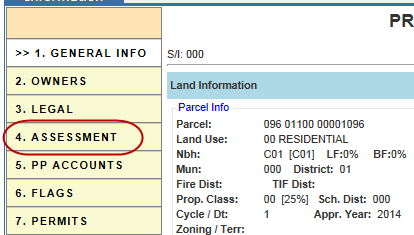

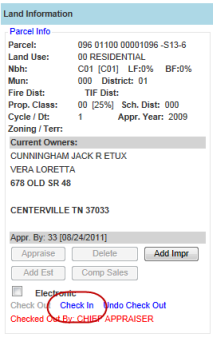

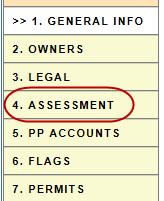

1. Open the desired parcel and go to the Assessment tab.

Note: Select the tax year one year prior to the current tax year.

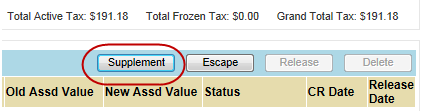

2. Click the Supplement button.

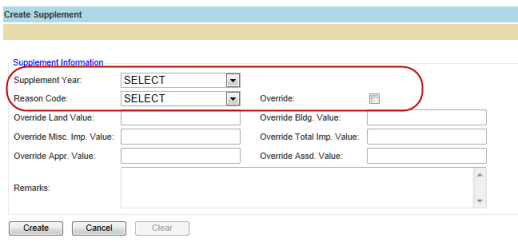

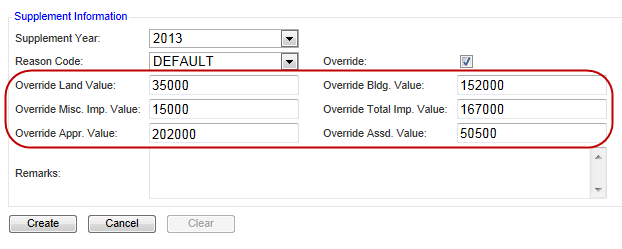

3. Select the desired Supplement Year and Reason Code from the drop-down menu. If the supplement is an override supplement, check the Override checkbox. Remarks may be added as needed.

Note: For Override supplements, skip to step 14. The following steps refer to creating a Normal supplement.

Regular Supplements

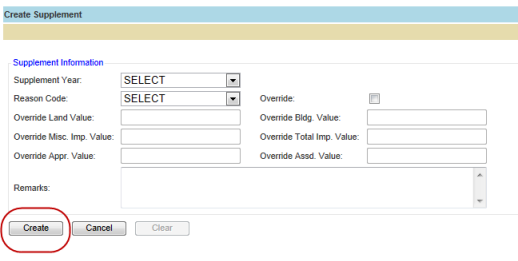

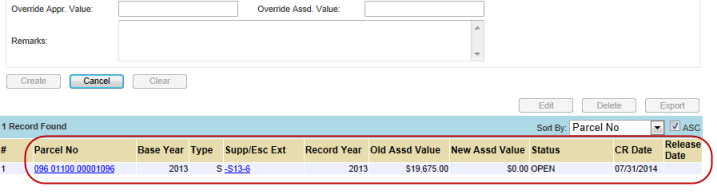

4. Click the Create button.

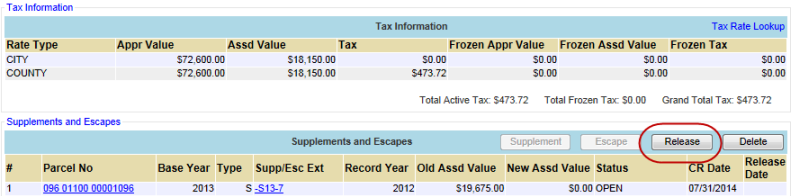

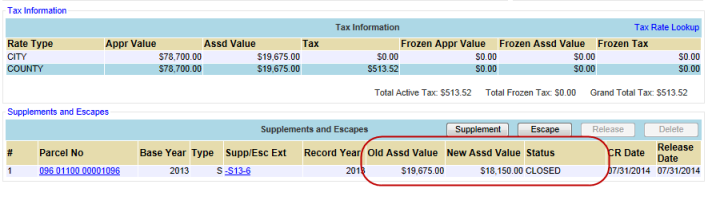

5. The new supplement will appear in the list at the bottom of the page.

Note: The Base Year for supplements will be the year in which the supplement was created; this will be one year prior to the current year. The Record Year will be the year for which the supplement was created; this will be the year selected in the dropdown menu.

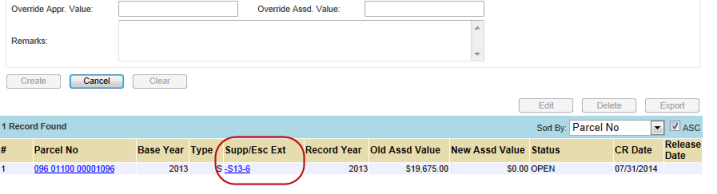

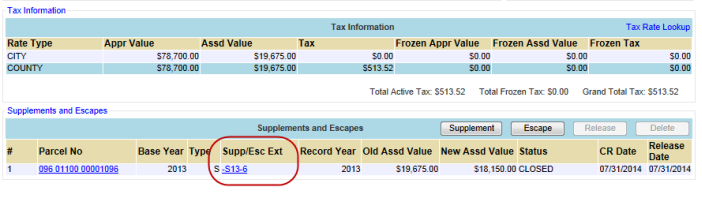

6. Click the Supp/Esc Ext link to open the supplement.

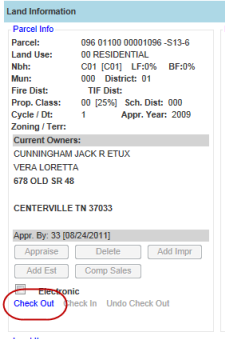

7. Check Out the parcel.

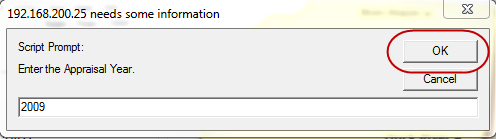

8. A pop-up will appear with the reappraisal year for the supplement. Confirm that the correct year is entered and click OK.

9. Make any necessary changes to the parcel, then Check In the parcel.

10. Go to the Assessment tab.

11. Click the Release button.

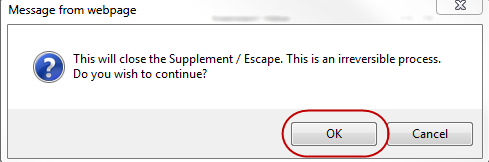

12. When prompted, select OK.

13. The supplement is now closed.

Override Supplements

14. Enter Override Values.

Note: The Override Appr Value and Override Assd Value are the only required fields. However, the breakdown of the value will only be available if the other fields are entered as well.

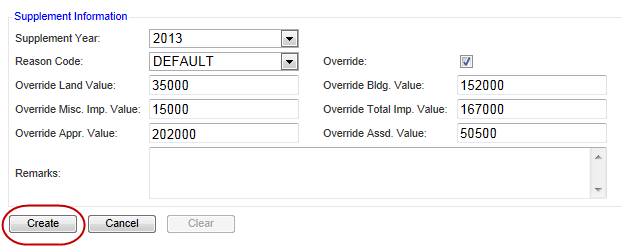

15. Click Create.

Note: The supplement will automatically close after it is created.

Multiple Supplements

16. Additional supplements can be created for the same parcel. These supplements are created using the same steps as above, however, there are there are some details to be aware of:

When creating a supplement from the original parcel record, all supplement years are available. A supplement can be created off of an existing supplement, but only that single year will be available.

If a second supplement is created for the same year, the older supplement will become Void and the newest supplement will take it’s place.

A supplement cannot be created on a tax year if another supplement is Open on the same tax year.

Generating Letters

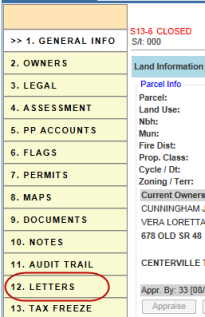

17. Click on the Supp/Esc Ext link to open the supplement record.

18. Click the Letters tab.

Note: Letters must be printed from the supplement record, not the original record.

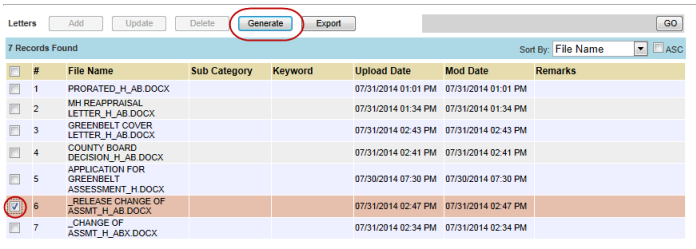

19. Check the box next to the desired letter and click Generate.

20. The letter will open in Microsoft Word. Any changes that are necessary can be made at this time. When ready, print the letter from Word.

Personal Property Supplements

Please refer to the Personal Property Quick Help.

![]()

Confidential | Copyright © 2001-2014 E-Ring, Inc.