![]()

Personal Property Supplements

The purpose of this help is to instruct the user on how to create and release supplements. Supplements are used to apply changes to accounts that have already been abstracted.

1. Open the desired personal property account .

Note: Select the tax year one year prior to the current tax year.

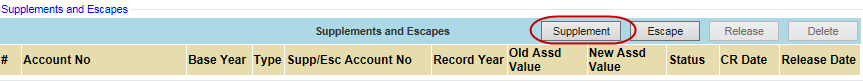

2. Click the Supplement button

Note: A supplement can only be created for an account if the rendition status is RECEIVED.

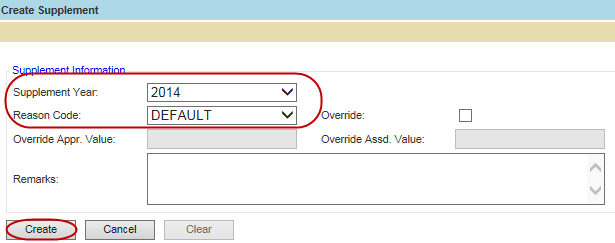

3. Select the correct Supplement Year and Reason Code from the drop-downs and click Create

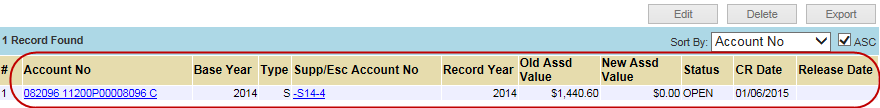

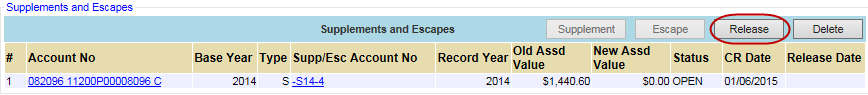

4. The new supplement will appear in the list at the bottom of the page

Note: The Base Year for supplements will be the year in which the supplement was created; this will be one year prior to the current year. The Record Year will be the year for which the supplement was created; this will be the year selected in the dropdown menu.

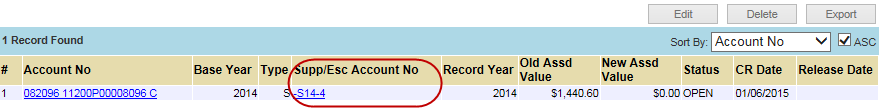

6. Click the Supp/Esc Ext link to open the supplement

7. Make any necessary changes to the account

Note: Make sure the rendition for the year in which you are supplementing is marked RECEIVED; if the status is not RECEIVED changes to items cannot occur.

8. Click the Release button.

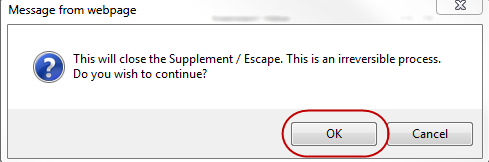

9. When prompted, select OK.

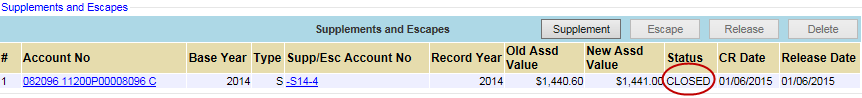

10. The supplement is now closed.

Note: Override Supplements may also be created on Personal Property Accounts.

![]()

Confidential | Copyright © 2001-2014 E-Ring, Inc.