![]()

![]()

Rollback

When Current Use comes off a parcel Capture allows users to assess taxes up to three prior years. Through the Rollback tab on the Parcel Information Dashboard users are able to assess the difference between what was paid when the parcel was on Current Use and what would have been due had the parcel been assessed at full value.

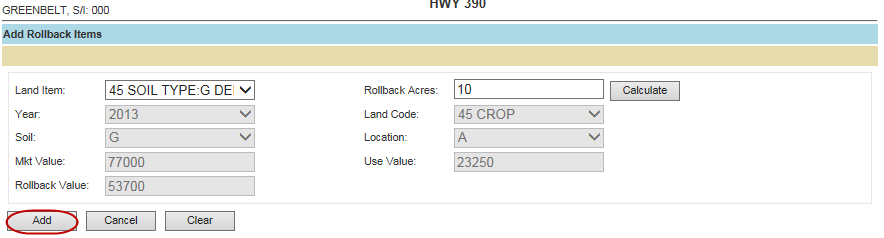

1. Open a Greenbelt parcel

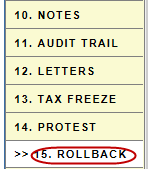

2. Click the Rollback tab

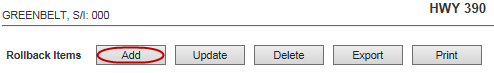

3. Click Add

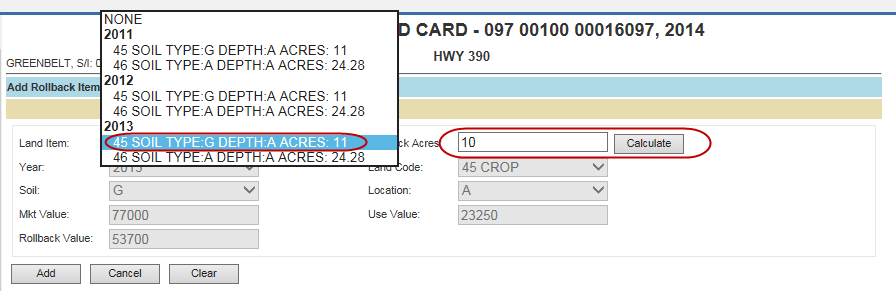

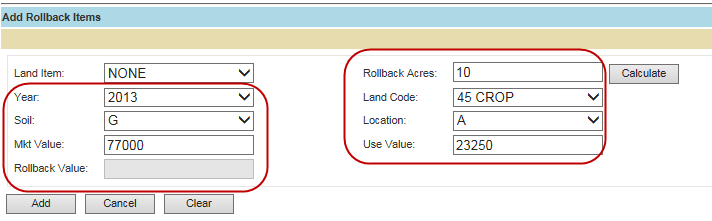

4. Select the correct Land Item from the dropdown

Note: The land items with Agricultural Use for the previous three years will display; If there are multiple agricultural items per record year they will be displayed under the correct record year. |

5. Enter the number of Rollback Acres and click Calculate

Note: To manually enter values do not select from the Land Item dropdown and manually enter the other information |

7. Click Add

8. Click Cancel

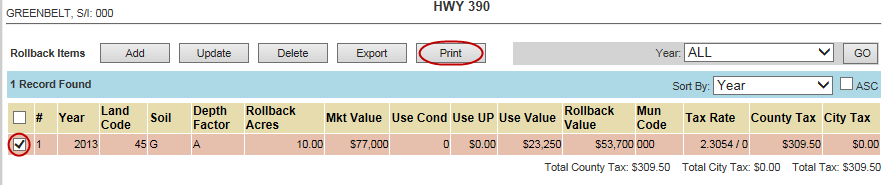

9. Place a check next to the appropriate Rollback item

10. Click Print

11. Deliver the print to the Trustee