![]()

PP Depreciation Rollover

The Personal Property Depreciation Schedule shows the % good for items in each depreciation year based on the current rate year. The depreciation schedule is updated annually. Personal property accounts must be regenerated annually to ensure the proper value for each item is correctly calculated. Items are separated into groups based on item type and depreciation rate as some items depreciate in value faster than others.

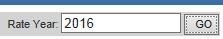

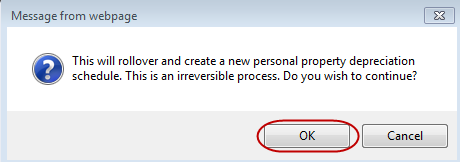

This Quick Help is designed to teach the user the process for rolling the Depreciation Schedule into the next tax year. The Depreciation Schedule must be rolled forward in order to generate the correct depreciation for Personal Property Items. Rollover is an irreversible process.

1. Log into Capture

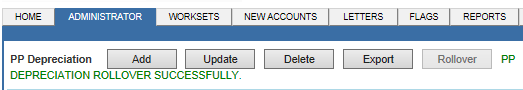

2. Hover over the Administrator tab and click PP Depreciation

3. Type the Rate Year for the current tax year and click Go

4. Click the Rollover button

5. Click OK when the pop-up appears

6. A message indicating a successful rollover appears

![]()

Confidential | Copyright © 2001-2014 E-Ring, Inc.