![]()

![]()

Individual Renditions

Defining Renditions

A rendition or schedule is a form that businesses must fill out each year to report the personal property they own. Taxes are based on the amount of personal property owned by individual businesses. Capture allows for the items from the rendition to be added manually or imported to the account.

The value of the items reported through the schedule are based on the Personal Property Depreciation Schedule which is updated annually. The rendition status must be marked “Received” within Capture before items can be added and manipulated/regenerated each year.

Accounts with limited items valued at or under $1,000 can be marked as a “Small Account” which will calculate taxes at a market value of $1,000.

Renditions in Capture

Update Rendition Return Status

Open a personal property account

Click in the General Assessment Information hyper-region

Change Appraised By, Rendition Status, and the Rendition Received Date in the General Assessment Information section

Click Update,

The rendition status will now read Received in the General Assessment Information region

Note: Check the Small Account checkbox in the General Assessment Information region to calculate taxes at a market value of $1,000. |

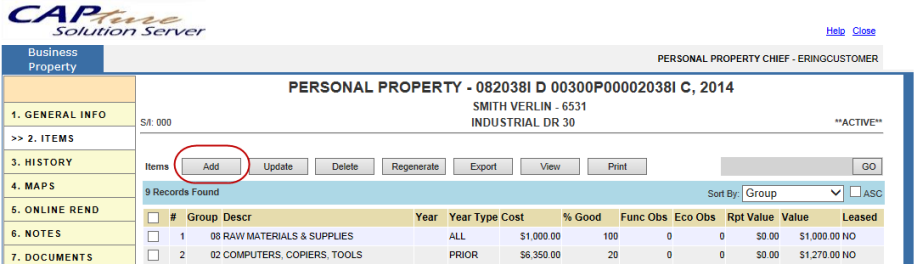

Items may be added, deleted, or edited by clicking the Items tab.

Add an Item

Click the Add button

Enter the requested information (Group, Acquired Year/Type, and Cost are required), click Auto Fill click Add

The item is added to the schedule, repeat as necessary

Add a Leased Item

Click the Add button

Enter the requested information (Group, Acquired Year/Type, and Cost are required), click Auto Fill

Check the Leased box

Fill in Lessor Information

Click Add

The item is added to the schedule, repeat as necessary

Edit an Item

Place a check next to the item and click Edit (in the update items screen)

Change necessary information

Click Auto Fill

Then click Update

Delete an Item

Check the box next to the item

Click Delete