![]()

![]()

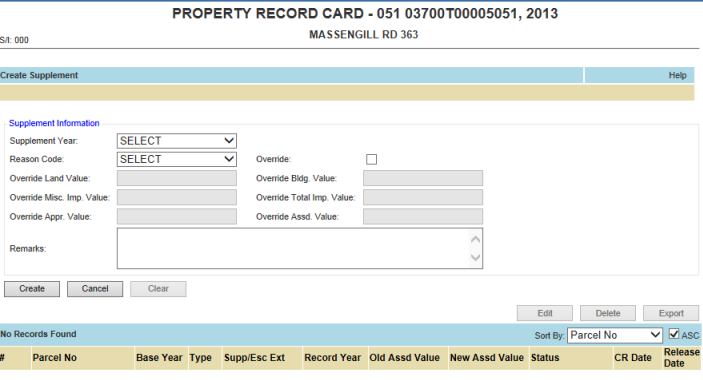

Real Property Supplements

Defining Supplements

A supplement is a replacement record for a parcel that has already been abstracted for the current year. Supplements are created to correct errors or update new parcel information. Common assessment supplements will focus on name, class, exemption, and agricultural use changes.

When a supplement is created, the original record for the parcel is voided. The voided record is considered an error record. The error record is replaced with a new supplement record that reflects the applied changes. Supplement letters can be generated in Capture to send to taxpayers to notify them of supplemented parcels.

Creating

Open the desired personal property and go to the Assessment tab

Click the Supplement button

Select the desired Supplement Year and Reason Code

Click create button

Note: Select the tax year one year prior to the current tax year. |

Open the newly created supplement by clicking Supp/Esc Ext.

To Make Necessary Changes to the Parcel

Check out the parcel by clicking Check Out

Confirm the correct reappraisal year is entered in the pop-up window

Click OK

Make necessary changes to the parcel and select Check In

To Release/close the Supplement

Go to the Assessment tab

Click the release button

Click Ok when prompted

Override Supplements

Open the desired parcel and go to the Assessment tab

Click the Supplement button

Select the desired Supplement Year, Reason Code, and Override checkbox

Enter in all Override Values and click Create

Note: The Override Appr Value and Override Assd Value are the only required fields. However, the breakdown of the value will only be available if the other fields are entered as well. |

Generating Letters

Open the supplement record by clicking Supp/Esc Ext link

Go to the Letters tab

Check the box next to desired letter